Loans extended by banks to micro, small and medium enterprises (MSMEs) increased following the central bank’s relief measures to ease the impact of the new coronavirus disease 2019 pandemic.

The Bangko Sentral ng Pilipinas (BSP) yesterday said for the reserve week ending July 23, 2020, 97 banks extended loans to MSMEs as an alternative mode of compliance with the new reserve requirement ratio with an average daily balance of P84.2 billion.

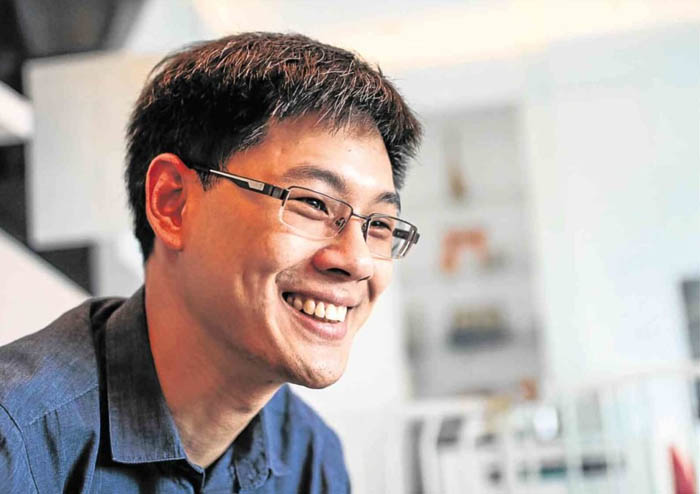

Benjamin Diokno, BSP governor, said this is a substantial increase of 750.5 percent from the P9.9 billion average daily balance of MSME loans used by 55 banks immediately after the effectivity of the measure during the reserve week ending April 30, 2020.

“This indicates that banks have continued to grant new loans or re-finance existing ones to MSMEs and large enterprises even through the quarantine. We see this contributing positively to whole-of-nation efforts to mitigate the economic impact of the health crisis,” Diokno said.

He added 13 banks provided loans to large enterprises as an alternative mode of compliance with the reserve requirement, with average daily loan balance of P12.3 billion based on preliminary data for the reserve week ending July 23, 2020.

“This represents a significant increase from the P376 million average daily loan balance to large enterprises which was used by 12 banks during the reserve week ending 04 June 2020, the start of the effectivity of the measure,” Diokno said.

Last month, the policymaking Monetary Board reduced by 100 basis points the reserve requirement of small banks in an effort to release liquidity to the countryside and mitigate the effects of various lockdown measures among the small enterprises.

Effective July 31, 2020, the reserve requirement for thrift banks is at 3 percent while for rural and cooperative banks, 2 percent.

“The reduction is expected to increase lending capacity of these banks to support financing requirements of their micro-, small- and medium enterprise as well as rural community-based clients,” Diokno said.

He said a reduction of 100 basis points on deposits/deposit substitute liabilities amounting to P1 trillion of small banks “will release estimated liquidity of P10 billion.”

The latest move is “part of the BSP’s omnibus package of reforms aimed at assisting the banking public with their liquidity requirements during the Corona Virus Disease 2019 pandemic and supporting the transition towards a sustainable recovery during the post-crisis period,” Diokno said.

At the onset of the lockdown measures in March, the Monetary Board approved a 200-basis-point reduction in the reserve requirements of the country’s big banks and non-bank financial institutions with quasi-banking functions.

On March 30, 2020, the reserve requirement for universal and commercial banks was reduced to 12 percent.

Analysts estimate that for every 100-basis-point cut on big banks’ reserve requirements, over P100 billion is released to the economy.